China is going pear-shaped as Beijing panics and wheels out the “monetary bazooka.”

Cue the Worldwide inflation.

Just a few weeks ago I did a video about how China is on the edge of recession. Weeks later, the edge of recession has now progressed to a full-blown Chinese fire drill.

So What Happened?

Last week, China’s ruling Politburo held an emergency economic meeting and decided to crank up the money printers to 11, pumping money to consumers, to banks, to property developers, basically to anybody who might spend it.

Bloomberg called it an “adrenaline shot,” as in it’ll pump assets but won’t last long.

Specifically, Beijing’s going to dump about 3.8 trillion yuan – roughly half a trillion dollars – to keep the economy running.

A trillion yuan goes to consumer subsidies, including a hundred twenty US per month child subsidy – a hundred twenty’s big in China – to bribe Chinese mothers into having more kids, which they’ve stopped doing.

Next up are the banks – as always – who get a cool hundred and forty billion US along with another 100 billion dumped into stock markets.

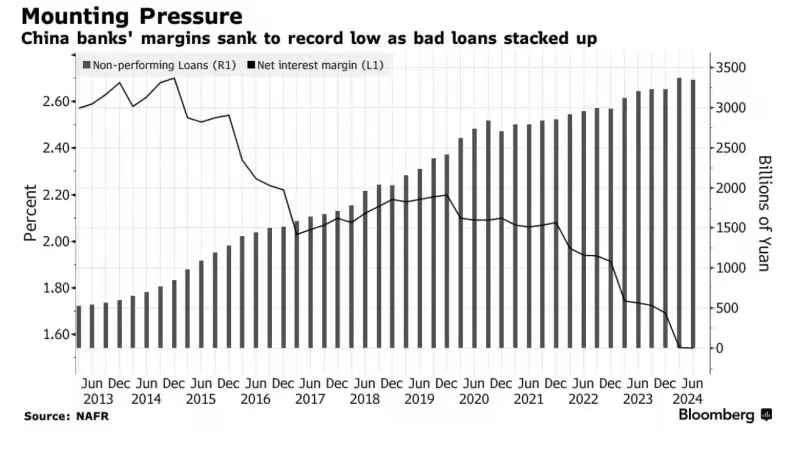

Allegedly this is all to spur spending – as in the banks lend the money out and the stockholders feel rich – but it would do wonders for the gaping holes in China’s teetering financial industry.

Beyond the Money Dump

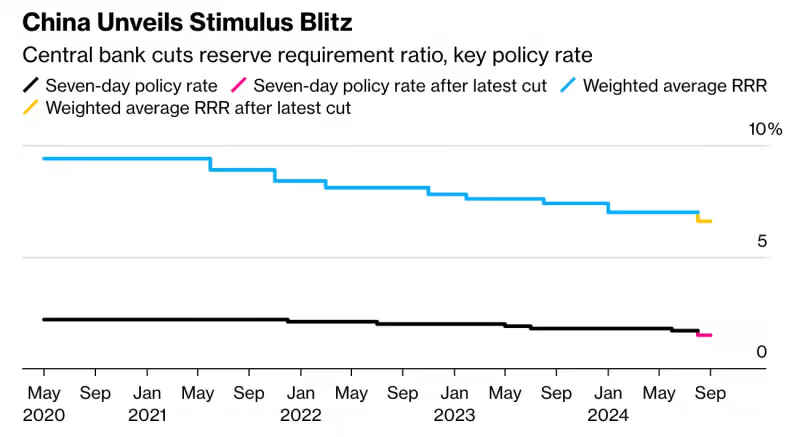

Beyond the money dump, China’s slashing interest rates across the board – which governments do to try and gin up some tissue-fire growth.

They’re slashing downpayment requirements on houses, opening a special credit facility so banks and hedge funds can gamble on stocks, and cutting the reserve requirements for banks – meaning banks can raid their vaults and go on a lending spree.

Put it together, and Beijing’s doing everything it can to get money out in the wild, down to bankrolling gamblers and pouring yet more trillions down the black hole of China’s comically over-built housing market.

You may have seen the ghost towns China’s built; here comes round two.

What Scares China

Why so desperate, you might ask?

Easy: China is panicked not only about a looming recession but that it might be falling into the Japan-style doom-loop of structural stagnation thanks to President Xi’s anti-business jihad.

The key number here is the interest rate on 30-year government bonds, which is a classic indicator of a zombie economy in the spawning.

Ominously, China’s 30-year just fell below Japan’s. Flirting with zombie territory.

What’s Next

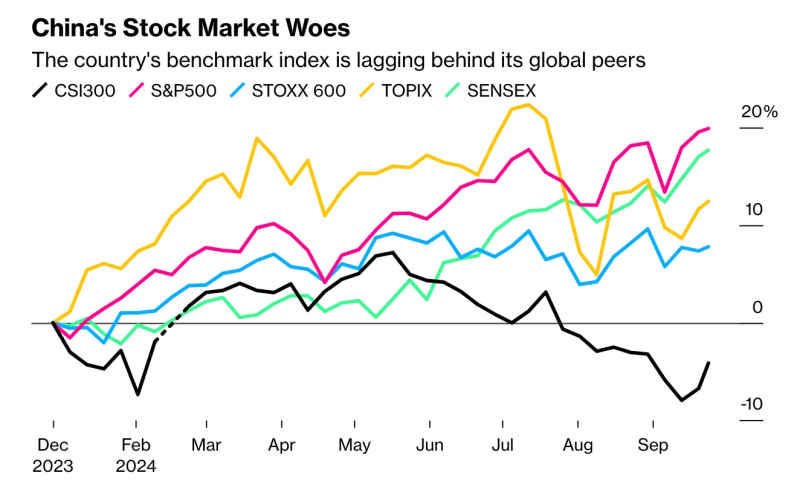

Near-term, they’re popping the bubble in Beijing with stocks soaring.

And while 4 trillion yuan is a lot of money, this isn’t yet the Big Bang – that would be a long-rumored 10 trillion money dump by Beijing.

They’re not there yet, probably because the US and Europe haven’t hit the meat of their recessions. Debt-fueled Americans are still buying Chinese exports.

If and when that breaks down, either because Americans are out of money or Trump rolls out tariffs on China, Beijing’s up against the wall, and it will blow out into worldwide inflation.

China’s Turn for Chaos

I’ve mentioned in previous articles how if China goes down, the Chinese people won’t have a sense of humor about it. This ain’t Japan where people shake their heads and obey.

Beijing knows this, they know the kinetic history of the Chinese masses when they’re angry, and if they panic hard enough they may reach for a war to both distract the population and to clamp down on dissent.

Just this week they launched a massive military exercise in a disputed area of the South China Sea, there could be more to come.

Good for Gold.

In my opinion, a thoroughly Western centric article that makes the assumption China’s economic fate is inextricably tied to the West. China has a long history that’s NOT linked to the West, for the most part.

I see too, not ONE mention of BRIC’s or BRICS+, as it will soon be known. BRICS opens up enormous economic opportunities for China, well beyond the realms of the West. India, for example, is set to become the worlds largest nation, a key BRIC’s member. Not to mention new upcoming member states like Vietnam, who recently worked with China on a rail network and are projected to grow substantially in the next decade.

https://www.reuters.com/world/asia-pacific/xi-visits-china-offers-rail-grants-vietnam-pushes-digital-silk-road-2023-12-11/

The reality is China is transitioning away from the West, re-closing its doors to a hostile group of nation states, dumping the dollar as a trading currency and that comes with some economic discomfort.

If this article was re-written to focus on the USA, I’d say its 100% on the money. A nation that for years has tried to print its way to prosperity, that uses wars as a means of making money for an elite, at the expense of everyone else. They already have one major war underway in Ukraine, another they may not be quite so keen on in the Middle East and a quite possibly a third focused on Taiwan, if they continue to provoke the Chinese.

All in the hope of making a quick buck and maybe, with any luck, shaking loose resources they desperately want if they can destabilise nations like China and Russia enough, such as gas, oil and rare earth metals.