How does the infamous vulture fund make its money?

US investment giant BlackRock has hit a new record on assets under management, topping $11.48 trillion in Q3 2024 – equivalent to the nominal GDP of Japan, India and the UK combined, and the valuation growing by nearly $2.4 trillion (the GDP of an Italy or Brazil) since Q3 2023 alone. How does BlackRock make its money? Sputnik explores.

Likened by some observers to a ‘modern-day East India Company’ in terms of sheer economic might and insatiable greed, BlackRock has been described in other circles as a classic vulture fund – seeking out profits wherever they may be found, ethics be damned.

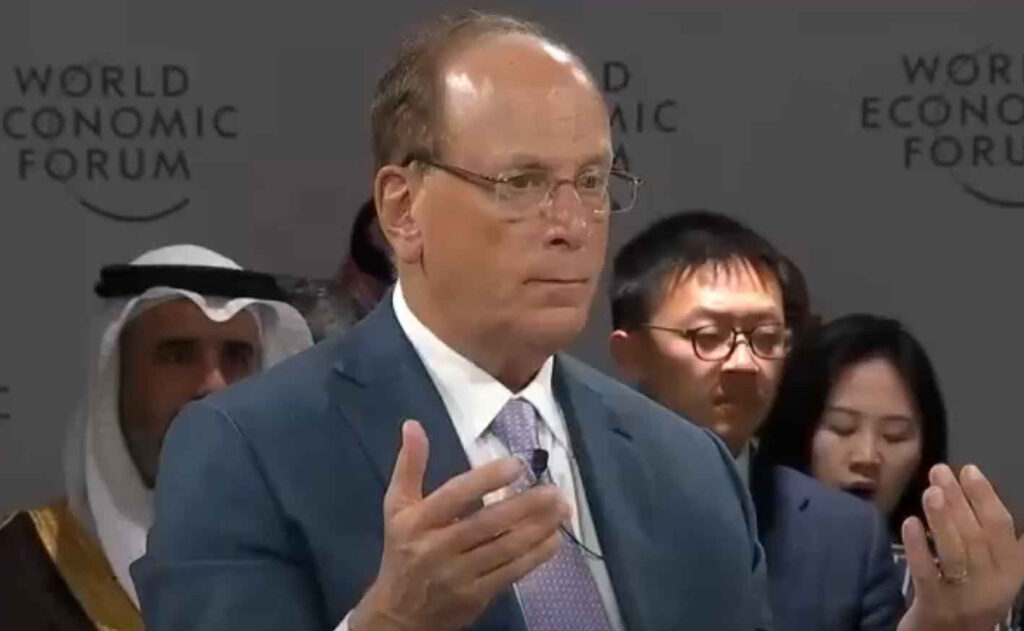

As CEO Larry Fink put it in a letter to clients in 2022, BlackRock “will not support policies that are good for society but bad for BlackRock.”

Created by a group of finance executives led by Fink in the late 1980s, BlackRock’s founders were pioneers in the so-called mortgage-backed security market – a risk-laden, bond-style type of investment representing claims on money generated by pools of mortgage loans.

Starting out by offering financial services, including proprietary software, to investment banks, the company expanded into mutual and exchange-traded funds in the 1990s.

Gradually building up its portfolio after going public in 1999 with a ‘modest’ $165 billion in assets under management, attributed by the company itself to its “strengthening relationships with global institutions,” BlackRock rose to global prominence during the 2007-2008 subprime mortgage crisis, which plunged much of the planet into a prolonged recession, but left the asset manager trillions of dollars richer.

Between 2008 and 2009, BlackRock’s assets under management climbed from $1.31 trillion to $3.35 trillion – a 250%+ boost in a single year. Surpassing the $4 trillion mark in 2014 to become the largest asset manager in the world, BlackRock more than doubled its fortune to $8.68 trillion six years later in 2020, as the Covid pandemic swept the globe.

BlackRock’s seemingly unstoppable rise and massive market power has been accompanied by an array of unsavory and highly destructive business practices, including:

- Lobbying against regulations which would restrict profiteering off developing nations trapped in debt cycles (a phenomenon Blackrock itself prefers to refer to as ‘unlocking income potential in high yield bonds). In practice, this has meant heavy investments into the debt burden of countries like Ethiopia, Ghana, Sri Lanka, Suriname and Zambia, and refusing debt cancellation or relief efforts, ensuring that countries are milked for tens of billions of dollars in interest payments long after they’ve paid off their original balance owing.

- Buying up tens of thousands of homes and other residential properties across the US via middlemen from 2008 onward together with other vulture funds like Blackstone, Vanguard and State Street, and turning whole generations of Americans into perpetual renters unable to ever afford a home of their own.

- Engaging in market manipulation (established by Italian market watchdog Consob in 2014 in a case related to BlackRock’s 2011 dumping of a stake in UniCredit Bank, which BlackRock attributed to a “technical error”). The financial giant has been accused of similar practices in relation to cryptocurrencies, including Bitcoin, although this has yet to be legally established by a regulator or in court.

- Lobbying politicians (including nearly $2.4 million in disclosed federal lobbying in the US in 2022) to benefit companies under management and ensure favorable regulation, taxation, etc.

- Profiting off the 2020-2023 COVID-19 pandemic through timely investments in technology and healthcare stocks – including over 7% ownership in vaccine makers AstraZeneca, Pfizer, and J&J, which helped boost BlackRock’s assets under management from $7.43 trillion in 2019 to $8.68 trillion in 2020, and $10 trillion+ in 2021.

- Fueling the US war machine, from the purchase of stakes in major defense manufacturers including Raytheon, Boeing and Lockheed Martin, to direct influence on US foreign policy – including BlackRock and JPMorgan’s much publicized commitment to pool capital for Ukraine’s “reconstruction” – a poorly disguised cover for the country’s systematic looting, in 2022. The banks have been given the power to essentially run the Ukraine Development Fund – which proposes over $400 billion in ‘investments’ over the next decade.

“I do believe, emotionally, those who truly believe in a capitalistic system will be flooding Ukraine with capital,” Larry Fink predicted in January 2023. “And I’m not talking about philanthropy…I’m talking about if we can rebuild Ukraine, it can be a beacon to the rest of the world of the power of capitalism,” the financier said.

“We have already managed to attract attention and have cooperation with such giants of the international finance and financial world as BlackRock, JPMorgan, Golden Sachs [sic]…Everyone can become a big business by working with Ukraine in all sectors from weapons and defense to construction, from communication to agriculture, from transport to IT, from banks to medicine,” Volodymyr Zelensky promised at a US Chambers of Commerce meeting in the winter of 2023.

“Ukraine is good for business. You know that, right?” an unsuspecting BlackRock recruiter told an undercover reporter in a hidden cam video the same year. “We don’t want the conflict to end,” the person admitted, pointing to the “fantastic” opportunities that “volatility creates” to make profit. “War is really F***ing good for business.”

Indeed, in both Ukraine and Gaza, UN officials have blasted BlackRock for its profiteering, with a recent OHCHR report citing BlackRock’s arms industry investments as signs of complicity in the Gaza conflict.

In May 2023, Russian permanent representative to the UN Vassily Nebenzia called out BlackRock by name, and outlined its sinister goals in no uncertain terms.

“What essentially is happening under the guise of attracting private investment for large-scale projects in key areas of the economy, is a transfer of state sovereignty to external corporate management of the world’s largest investment fund, headquartered in New York,” he said.

Like the Zionist privately owned BIS, (the central bank of central banks), the Zionist privately owned Blackrock is (the corporation of corporations), or the “parasite of parasites”.

The world is run through corporations (corporatocracy) and Blackrock is the one that rules them all.

It used to be called a Jewish World Conspiracy or a One World Jewish Conspiracy or a One-World Plan of World Jewry. It’s now known as a New World Order, or a One World Government, or the Great Reset or Agenda 2030 ect.

Whatever it’s called, its real, here and red light flashing dangerous for we the people. Its being carried out through the Zionist owned and controlled corporations who collude and contract between each other to carry out and achieve this dystopian plan of a Zionist/Communist run world.

As Henry Ford stated, “the economic problem of America and the world is ultimately a Jewish problem. The money question, properly solved, is the end of the Jewish Question and every other question of a mundane nature.”

And good ol Labour arranged for them to come to NZ, with a warm welcome offered by our current so called “government”……

Black Rock is a criminal company profiting from great and wars. Flin should have been hung well before 2008 GFC