I’ve just had a look through the Reserve Bank of New Zealand’s (RBNZ) online survey on ‘Digital Cash’ (their euphemism for central bank digital currency (CBDCs)), and it’s far worse than I thought it might be. The survey finishes in a few days, on July 26.

The RBNZ survey is a remarkable example of a government institution constraining their thinking in such a way that might prejudice an outcome in their favour.

I consider it extraordinarily irresponsible and vastly unreasonable. The survey does not permit public reasoning – especially contrary perspectives to be given – that can explain in a sophisticated and authoritative manner why they diverge from the RBNZ’s desire to release CBDCs.

It is not possible to answer the survey questions in such a way that communicate the complex issues at stake, that could be taken seriously by officials. The tick box survey questions prohibit this.

People can upload a written submission. Confusingly, the written submission is entirely different to the survey, but achieves the same ends. There is no capacity for the public to reject CBDCs or request that CBDC work is halted. Feedback is asked on objectives, principles, design models, … why the benefits are benefits. But no question grants permission to criticise CBDCs and the power that comes from people having a government managed digital identity tied to a government managed central bank account.

Government agencies, with devastating consistency, dismiss and ignore submissions that don’t directly respond to, or speak to the exact line of questioning.

The questions suggest that the average Kiwi can be led by the nose to answer questions that, again and again, risk conflation and confusion. The RBNZ use the term ‘digital cash’. Yet digital cash already exists in bank accounts. Using the term ‘digital cash’ to refer to CBDCs is misleading and confusing. Most of the questions in the survey could equally apply to digital cash in commercial bank accounts. It’s frankly, a terrible survey.

I authored an 80-page report with PSGRNZ, Stepping Back from the Brink: The Programmable Ledger. Four democratic risks that arise when Digital IDs are coupled to Central Bank Digital Currencies. People can also access a 2-page summary, and read articles in The Daily Telegraph and Brownstone Institute. Reality Check Radio’s Our Digital Future series includes interviews with a wide range of experts which include ex-RBNZ staff.

Other groups such as the Taxpayers Union aren’t happy about CBDCs either.

Legacy media has tended to cut and paste the opinions of bank officials on this topic and have not conducted any critical investigative work. A recent New Zealand Herald interview with the official Ian Woolford, the head of money and cash and individual that is overseeing the Digital Cash consultation, reinforced RBNZ’s focus on monetary sovereignty. Of course, Woolford, who wants to get the tech over the line, gave no critical perspective as to the risks – especially the power shifts – that would likely arise, should the RBNZ gain the power to release central bank digital money.

PSGRNZ sent our publication and a press release to NZ Herald editor on June 2, but there has been no interest shown in our publication. Editorial discretion is exceptionally important. We accept that.

Consultation processes in New Zealand often involve surveys where the public must respond to a set of questions. This process might suit officials, but I have observed their questioning styles have the effect of ensnaring the public into a set of replies, down a route of response, that fails to address greater complexities and larger problems – foundational issues that the policy at hand.

The officials who have drafted the questions are part of the team responsible for getting the policy over the line, into law and operational. They’re certainly not going to draft questions that involve the public responding with a flat ‘no’ to the policy at hand. So, there is no capacity to decline the policy.

Officials, including RBNZ officials, also don’t let the public see all the questions together to see if the public can actually say ‘no’ to a given policy at any stage of the survey. The public then dutifully fills in the questions and gets to the end of the survey and asks, ‘what actually happened here?’ They thought there would be a chance to respond, but it never happened

It is likely that RBNZ staffers are working so closely with management consultancy firm Accenture that larger issues concerning the public interest simply do not occur to them – they see the opportunities the way the corporation does. In PSGRNZ’s paper we dedicate a chapter to regulatory capture.

The public are, I personally believe, disserved, and misled by such a process, which of course is managed by the institution (the RBNZ) which has the most to benefit from social acceptance, or acquiescence, to the policy.

But what we are talking about here, is the ability to print money. This is huge.

To provide insight to the reader, in the below section I show screenshots of the RBNZ survey questions, and roughly highlight the issues I believe are brought to the surface. Unfortunately, these issues remain unaddressed, and unable to be addressed, through the action by the public of answering of the RBNZ survey questions.

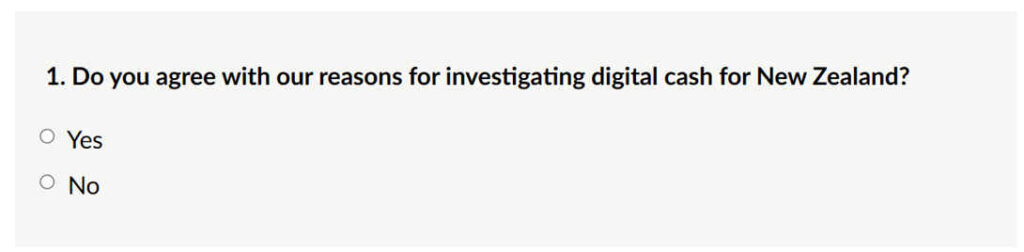

Question 1 – the public cannot say they do not agree with CBDCs, they can only disagree with the RBNZ’s ‘reasons’ for investigating ‘digital cash’.

Why can’t the public say yes or no?

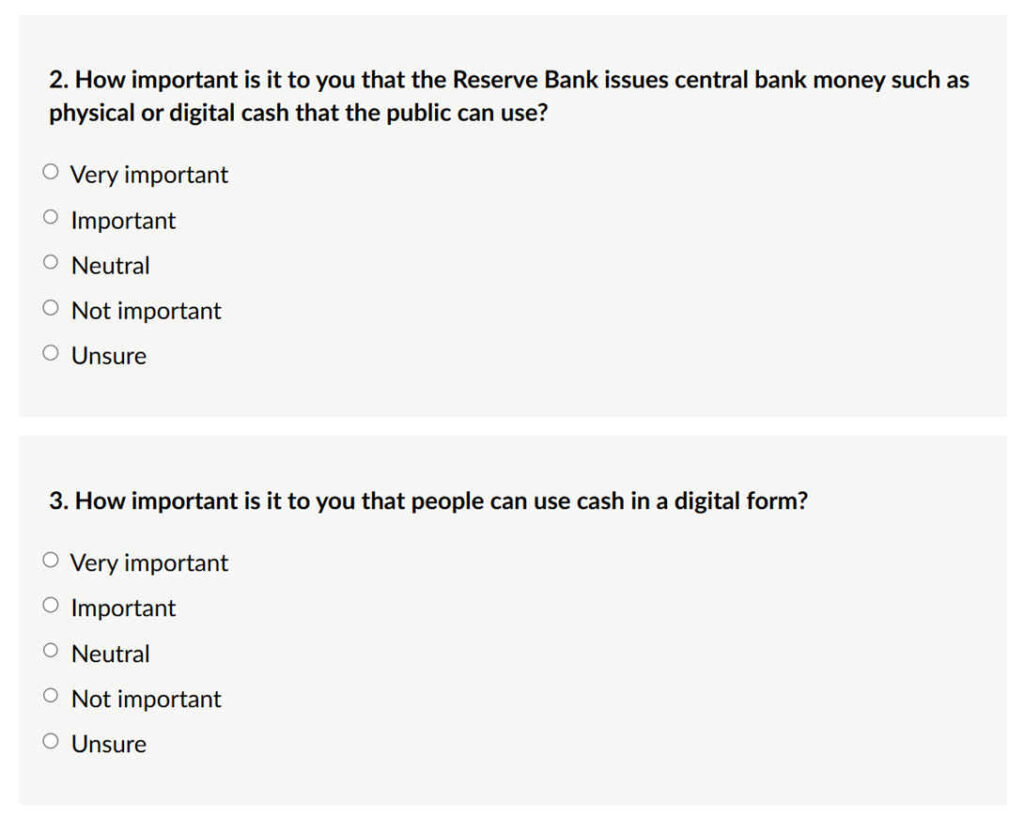

Question 2 conflates issues to secure consent for the new policy. They collapse the question around it being important to use physical or digital cash. We are unable to say yes, it is important to use central bank issued physical cash, but not central bank issued digital cash.

Question 3 also confusingly conflates issues to secure consent for the new policy. By using the term ‘digital cash’ when they (in this consultation) refer to CBDCs which will be necessarily programmable – they piggy-back on a 40-year history of use of digital currency, from visa, to mastercard, to EFTPOS which is also cashless currency – digital cash. Clever, but misleading.

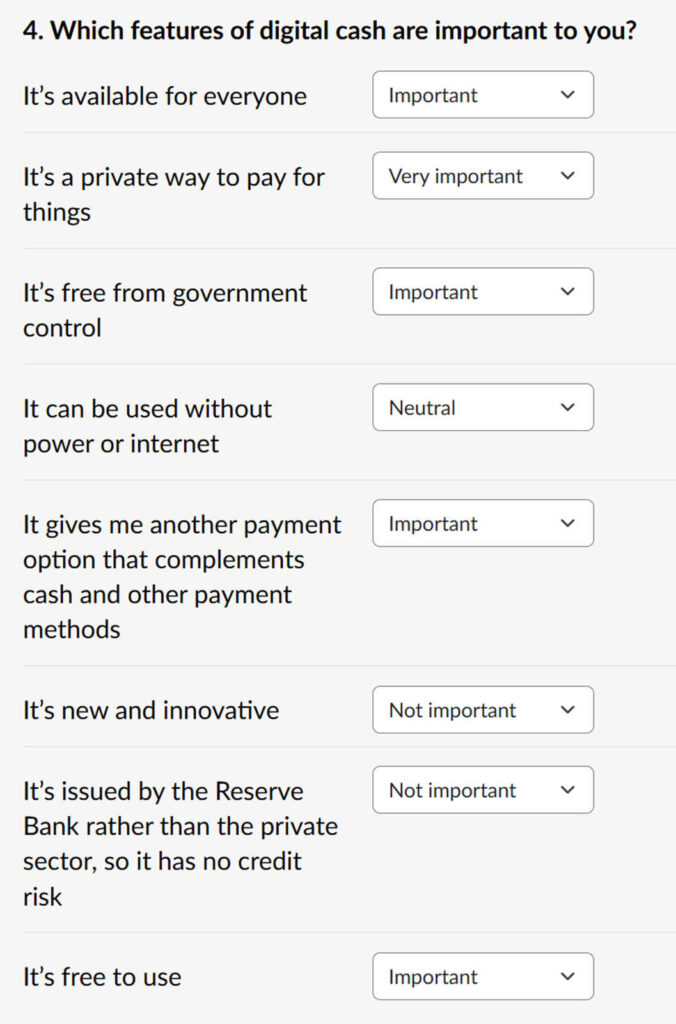

You can see my personal responses here in Question 4. I am unhappy with my responses, but I am corralled into answering a certain way. When I say ‘Free from government control’ – I actually do not want a finance system free from government control, I want public interest regulation, to stop abuse of power, including the imposing of excessive fees and domination by a small group of large retail banks. But I am answering simplistically because I have been forced to answer in the context that I do not want government oversight over every payment I make.

We see the tendency by the RBNZ to only talk about ‘the good stuff’ and fail to give the public an opportunity to tick on boxes that include risks relating to civil, constitutional and human rights.

The statement that ‘it has no credit risk’ might be true – Reserve Banks are protected institutions. But Reserve Banks can still impose negative interest rates, withdraw funds and freeze bank accounts.

Unfortunately, the technologies that enable CBDCs to be deployed enable functions to be undertaken at scale. For example in an emergency, many bank accounts could be frozen at once. The programmability functions (smart contracts), which can be deployed not only directly but remotely, by third parties, are what also make CBDCs different from digital cash, (and this is discussed at length in our paper).

There are no survey questions which enable respondents to discuss risks relating to smart contracts, programmability and application programming interfaces. These components will be essential to the functionality of CBDC systems.

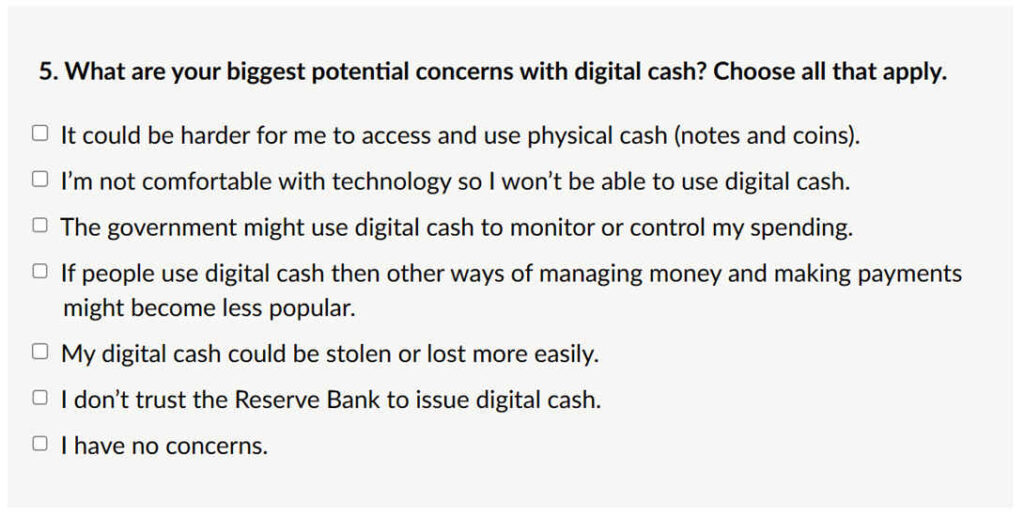

The technological capability of CBDCs is the critical difference between CBDCs and digital cash. But Question 5 solely permits the public to say ‘I’m not comfortable with the technology.’

What does ‘comfortable’ infer? Usually this infers a person has limited experience with a technology. It doesn’t suggest more sophisticated concerns about the technological capacity of the tech and the potential for decision-making to be black-boxed and unaccountable.

People might not be comfortable ticking a box that says the ‘government might use digital cash to monitor or control my spending’. There’s no box: ‘risk of increased government oversight and abuse of power.’

Again, Question 5 concerns CBDCs, but is again, confusing because it conflates the issues. The sentence ‘other ways of managing money and making payments might become less popular’. Most ‘other ways’ involves digital cash – it’s just retail digital cash, not central bank digital cash. People have to keep double-thinking in order to answer the questions. The same applies to the sentence relating to digital cash being stolen or lost.

The sentence ‘I don’t trust the Reserve Bank to issue digital cash’ is probably the most awful.

Most people might not understand that New Zealand’s central bank has an even greater range of responsibilities than most central banks –

‘The Reserve Bank is a ‘full service’ central bank, meaning we have a wide mandate that spans monetary policy, financial stability, cash operations, and financial markets infrastructure. When compared to other jurisdictions, it is clear that the Reserve Bank fulfils a wider mandate than many of our international comparators or counterparts.’

I want to trust the RBNZ to do a great job in all these areas.

There is a great reason to consider that granting the powers to the RBNZ to take it upon itself to release digital cash, might conflict with the Banks other powers and responsibilities, and create a situation where there is the potential for abuse of power.

But I can only tick yes to ‘I don’t trust the Reserve Bank to issue digital cash’. I am corralled into a stupid and simple response that makes me sound ignorant. (PSGRNZ dedicate a chapter to the question of trust in the Stepping Back from the Brink paper.)

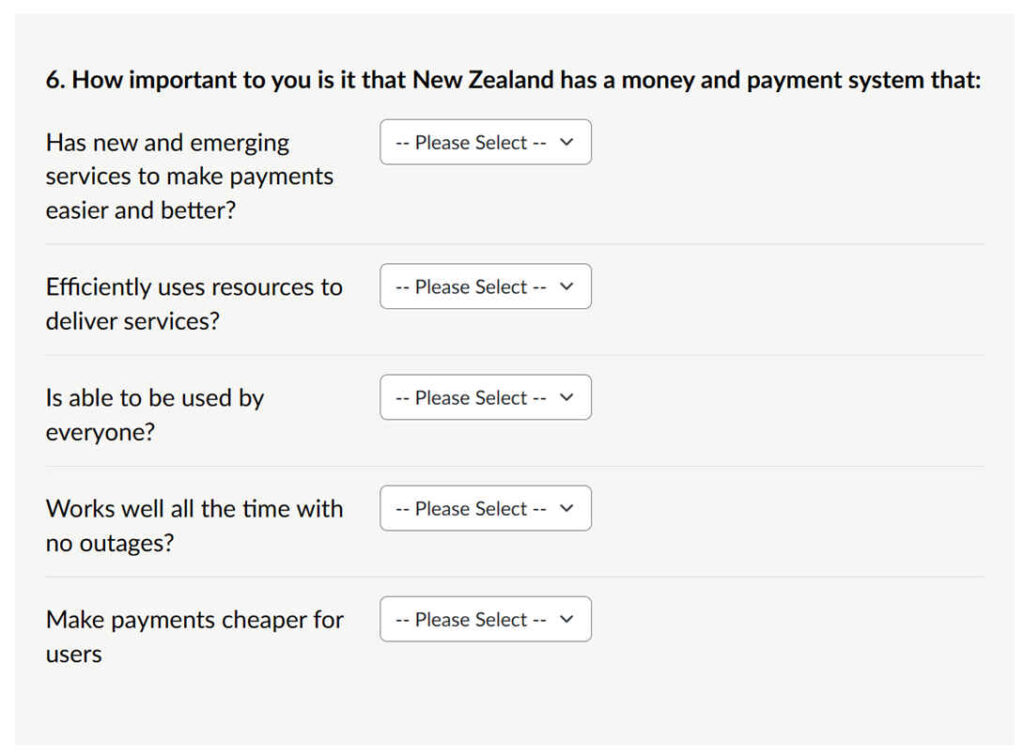

Question 6 should easily apply to the retail environment. Yet by making this part of the RBNZ survey, it appears to be rhetorically applied to manufacture consent CBDCs (which can be positioned as cheaper for the public to use) and urge for more investment into CBDC technology.

This is instead of, for example, the RBNZ taking on a job as a steward to support all retail banks to improve in all of the above-listed areas.

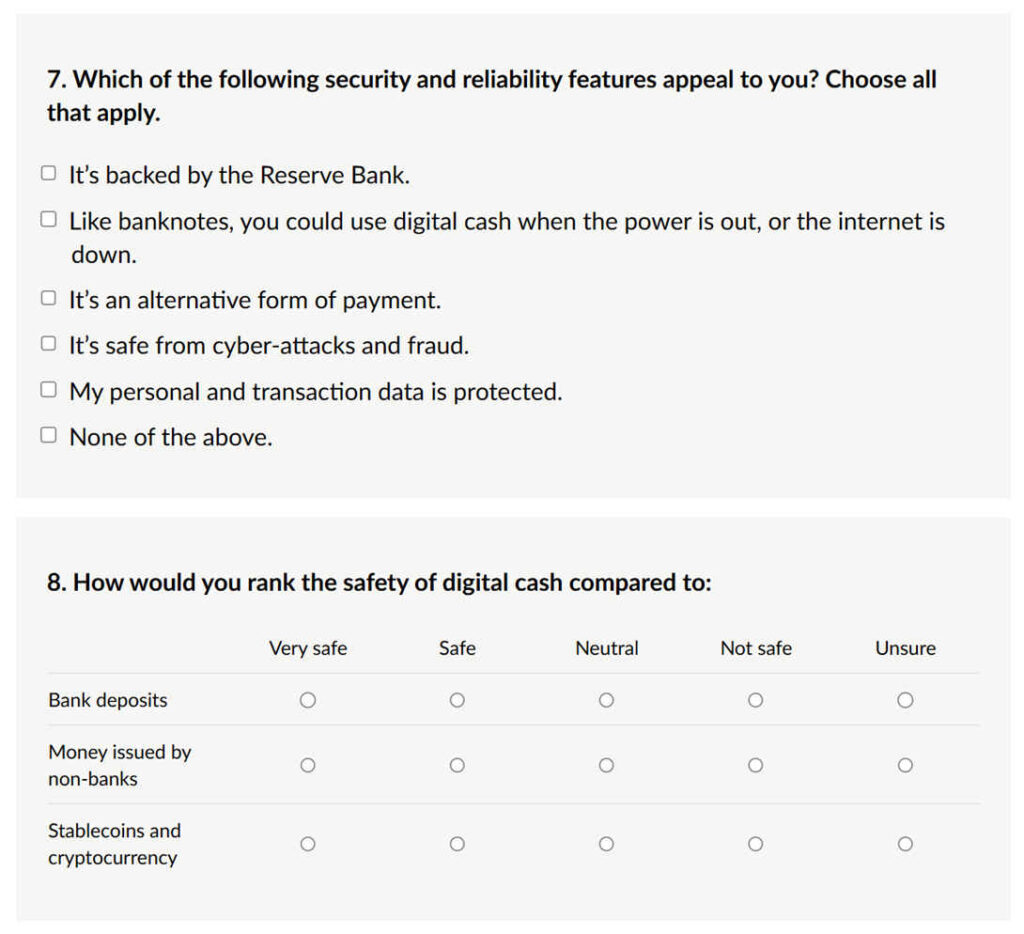

Question 7 is largely theoretical, as the technology to use CBDCs when the internet is out is still in process. The question is why isn’t the RBNZ stewarding consultation to support retail banks to ensure that they also work together to ensure that people can trade in power/internet outages.

The other option is to recognise that the risks are not able to be mitigated. Therefore the RBNZ as regulator must always ensure the public has adequate access to cash – so that if there was a disaster the public had adequate cash for long-term outages.

The claim that CBDCs will be safe from cyber-attacks and fraud remains a claim – again unproven. All institutions will be subject to attacks, and over time security might be better or it might be worse.

Personal and transaction data will be accessible by government entities, there will always be capacity through back-door processes for government institutions to access personal and transaction data, either to correct errors, or through emergency legislation or if compelled through the intelligence and police authorities. Again, the programmability-potential of CBDCs ensure actions can be taken at scale.

Question 8 also remains largely theoretical. We cannot rate the safety of CBDCs against these other forms because their safety remains untested and unknown.

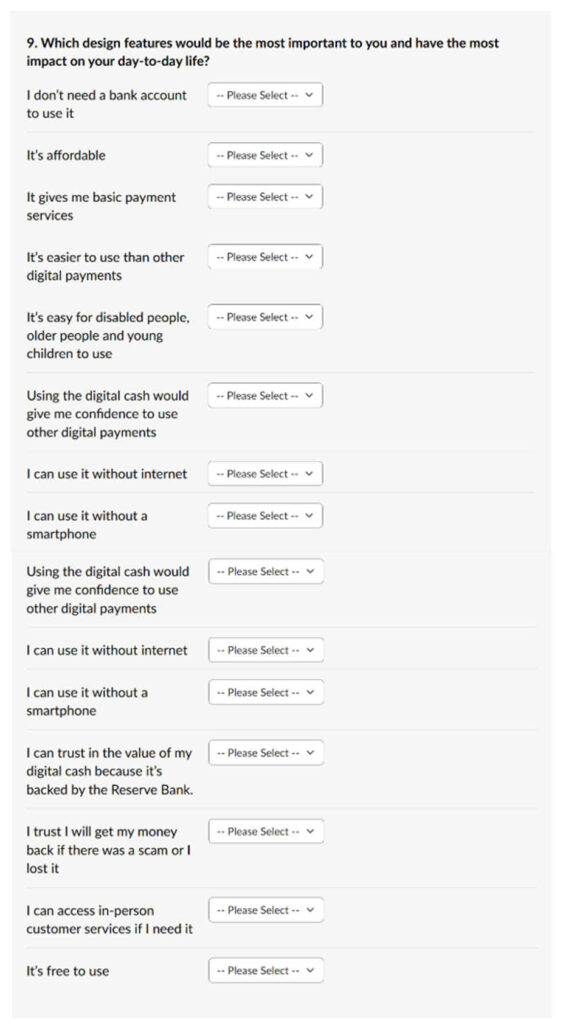

Most ‘design features’ in Question 9 equally apply to retail banks and there is no reason that the RBNZ should not be working with retail banks to ensure that retail digital cash includes these features.

The RBNZ state that a feature is that people can ‘trust in the value of my digital cash because it’s backed by the Reserve Bank.’ This is misleading for many reasons. One reason is that the value of a currency is highly dependent on how that country stewards the economy and deals with inflationary drivers (such as a failure to prevent speculation in residential real estate).

Question 9 once again glides over the powers that would be secured should they be able to release CBDCs – greater oversight over private transactions and power to impose fees and negative interest rates.

One of the reasons central banks want to release CBDCs is because they fear that if other central banks ‘get there first’, people will transfer their money (and their trust) – as a currency flight – to other central banks in foreign currencies and we ‘lose out’. This is again, theoretical and indications point to a reluctance to use central bank digital curriencies.

Countries that have introduced CBDCs are having to impose them on the public, such as paying public servants in CBDCs, and not giving them a choice of a retail account to pay into. But even in China, the public are quickly exchanging CBDCs for non-central bank digital currency.

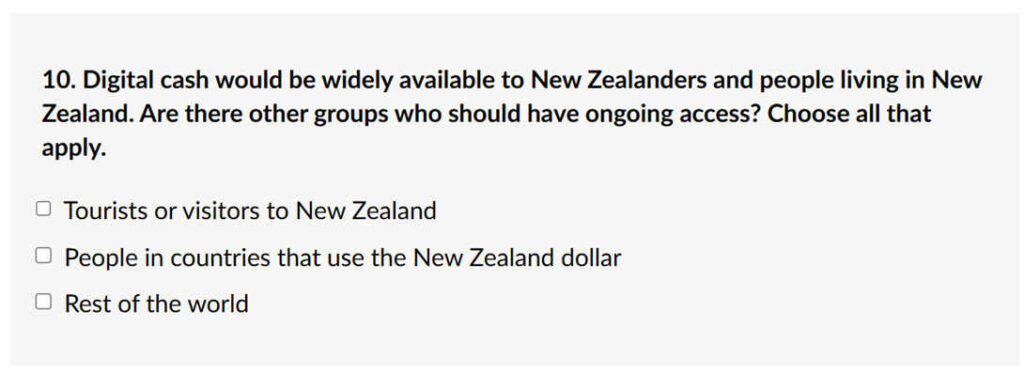

Question 10 might concern the anticipation that a local central bank will hope that they may become a trusted CBDC and people from other countries will choose to use our bank. But it is again theoretical, and a question that might be asked way down the track.

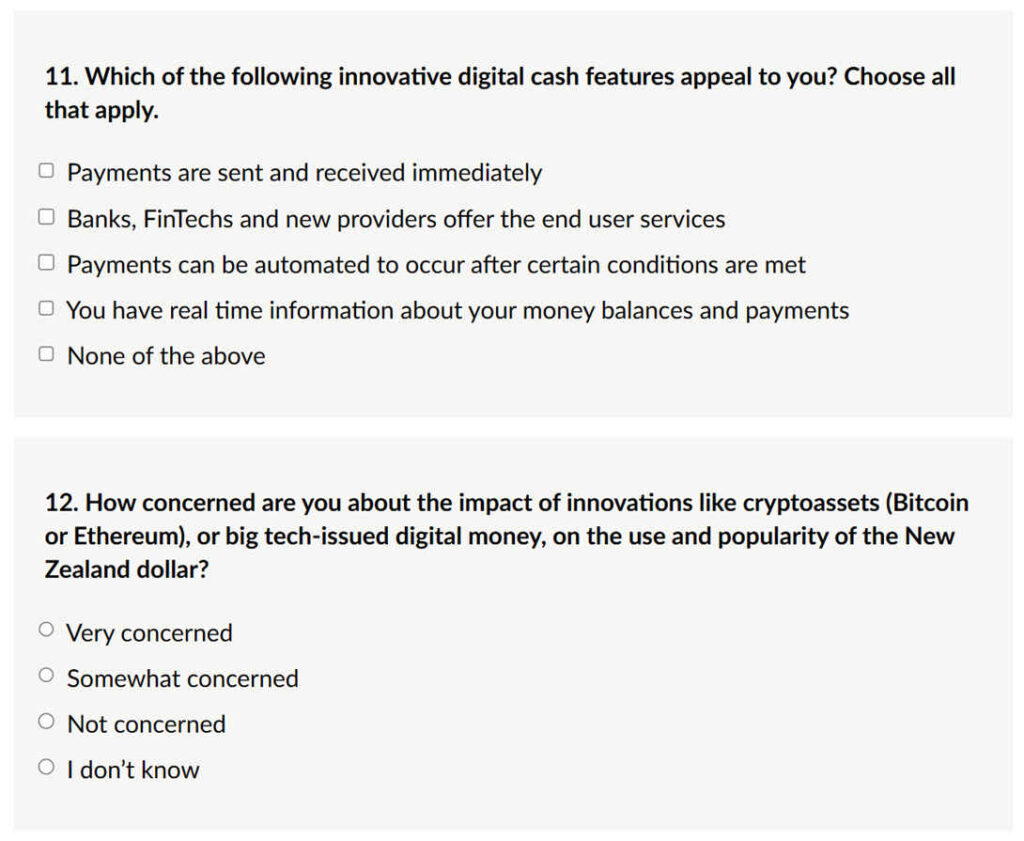

Question 11 – again –concerns technical challenges that are equally relevant for both the retail and wholesale currency market. But again, somehow, the RBNZ is inferring that this is an issue solely for CBDCs.

RBNZ obviously understand that this is a global challenge, but by asking this question they seem to be implying that this problem might be more quickly addressed by global central banks than in a freemarket environment with support from governments.

Question 12 is simply a fishing question, but again, it does not permit the public to respond to why or why not they might be concerned about all these different crypto/tech currency solutions. Any response should be nuanced and involved a weighting of vastly different risks. The question is inane.

As the Back from the Brink paper outlines, it is very apparent that the Bank of International Settlements (BIS), who is leading policy development on CBDCs, envisage that in time all central banks will be interconnected on unified ledger systems. This would give the BIS extraordinary oversight powers.

It might also lead to perverse incentives of governments to over-regulate cryptoasset markets to support oversight and market power and control by the BIS and central banks. I have my own concerns about cryptocurrencies and view it as subject to the same monopolistic forces as other forms of asset aggregation, but consider that central bank power has to be examined if we are to retain anything like the democratic governance system discussed in textbooks.

In authoritarian unified systems, which is what might happen if central banks existed together on unifed ledgers and the majority of public account balances were held there, technical questions can be very quickly and efficiently addressed.

But rules can be imposed behind closed doors, and leave Parliaments and civil society without recourse and lead to significant rights impositions, should things take an authoritarian turn.

Please, if you disagree to this article, let the Daily Telegraph or PSGR.org.nz know.

The RBNZs (digital cash) CBDC consultation closes this Friday, 26 July.

I hope people might be compelled to send in a simple one-page submission that clearly states a yes or no and why they favour or disagree with CBDCs.

I also hope that the public of New Zealand demand that the RBNZ disclose the balance of yes’s and no’s so that we may understand where the balance of support for CBDCs sits. We can observe in an earlier consultation (discussed page 24), that the RBNZ was fuzzy on whether CBDCs overall were favoured or not.

It’s seemingly easy for the RBNZ to relegate people who disagree into some form of ignorant troglodyte who simply can’t understand how important central bank digital cash is to the RBNZ. By doing this the RBNZ can exclusively maintain the rationale of maintaining monetary sovereignty as they claim.

But RBNZ’s role is so much greater than this, and stewarding the financial markets to retain trust in the New Zealand dollar is an even more important job – which must be balanced against all the other roles.

But the RBNZ have never discussed the potential conflict of interest – and unfortunately, we haven’t seen academics and legal experts coming out of the woodwork to look at all the issues in a broader context. There’s a complete academic vacuum.

CBDCs remain largely untested and where they are tested they have been forced on citizens. They are a child of the Bank of International Settlements and the Fintech industry.

The RBNZ’s partner in the CBDC campaign is Accenture, a management consultancy company that has been working collegially across the global finance and technology world for years, developing policy and encouraging the introduction of both digital identity systems and CBDCs.

The RBNZ has downplayed the fact that CBDCs will be toggled to digital identities, and that this union of technologies greatly expands government oversight over private activities.

The RBNZ has downplayed the fact that they can continue to ensure that cash is easy to access, and can put in place the regulatory rails that ensure small and medium size businesses can still easily accept cash, and not face additional regulatory costs.

PSGRNZ concluded that CBDCs brought four democratic risks to the surface. Yet the RBNZ survey does not give New Zealand society a chance to discuss any of these issues.:

- Digital IDs coupled to central bank digital currencies (CBDCs) enhance all-of-government oversight over private activity.

- CBDCs will be transferred electronically using pre-programmable smart contracts.

- The potential for erosion of parliamentary oversight.

- Continued increase in oversight and delegation of the production of strategy, policy and rules to the International Monetary Fund (IMF) and the Bank of International Settlements (BIS).

As a result of all of these risks, PSGRNZ recommend:

- A 6-year moratorium on any CBDC trial or project, at least until 2030.

- The RBNZ is not granted authority to issue CBDCs until after 2030.

The risks are manifold and discussed at length in PSGRNZ’s discussion paper Stepping Back from the Brink: The Programmable Ledger. Four democratic risks that arise when Digital IDs are coupled to Central Bank Digital Currencies. The 2-page summary can also be read online.

If you have a chance to review our paper, perhaps then go to your favourite New Zealand legacy media website and look for an exploration of any of the issues discussed in our paper – in the legacy media.

Most Kiwi’s want to trust the legacy (including publicly owned) media, but when a media abstains from critical enquiry, government agencies can take extraordinary steps which result in startling shifts of power, because the absence of public debate (and opprobrium) – the silence of the masses – can be inferred as acquiescence for a new proposed policy or process.

These are the techniques of authoritarian regimes, rather than a democratic nations.

Great analysis of this horrible survey. Reminds me of the of the recent online census – maliciously designed to trick people into divulging much more information than what was actually required.

All people in power want to protect themselves in techno-fortresses instead of being up front with and accountable to real people.

I greatly support a six year moratorium before stepping blindly into the digital maelstrom; people of all ages and walks of life will need a far better understanding of the vagaries involved in maintaining a functional system that does not upend itself over a technical whim.

One should read ” the tower of Basel” by Adam Lebor. Worth the read really reads like a thriller, only it is based on history and historical events and very well referenced .

It is about the creation and the rise of the Bank for International Settlement or BIS in Basel Switzerland.

Created to facilitate payment of war damages from Germany to France begin 1930, it facilitated the re armament of Germany and much more. (But payed no war damages to France)

Anyway, it rose to be the Central Bank of Central Bankers and is very much implicated in the creation of worldwide digital currency ( from memory ” project Icebreaker”: to verify). There are already ” try out” between Norway and Israel with digital currency. And i am quite sure the New Zealand Central bank is a member of the BIS.

It is said that the BIS is a “creature” of rothchild. Not many knows of its existence or have heard of it while it is at the center of all currencies manipulations

If you want to know more about the BIS, just google it. Usely number of banking articles rolls out

Really good article, thanks. Remember not to take the Mark of the Beast

I do not now nor will I ever consent to your digital currency. Shove it where the sun don’t shine. best way to avoid most scams DON’T DO DIGITAL BANKING.

I tried to fill this out. Couldn’t deal with the bullsit options so backed out. What a farce.

This is a small country, they can’t hide from us forever, if they impose this crap on us they better LOOK OUT 😡

We’re not falling for the digital cash BS.

USE CASH and spread the word.

People often say to use cash, but cash’s value will be artificial destroyed in order to make us switch to CBDC.

A really great critique, thank you. I started doing the survey and got really angry at how very biased it was, so I uploaded my own submission saying why I a) found the survey useless and biased and b) critiquing the confusion of ‘digital cash’ with CBDC’s and c) what I saw as the risks (for which I am grateful for the PSGRNZ paper.)

They may not accept my submission as it didn’t follow the format they wanted, but hey, we have to do something…..

I notice Auckland Council does the same biased thing with it’s public consultation surveys – infuriating.