So asks the Wall Street Journal, in an uncharacteristically gloomy article for the bull market’s paper of record.

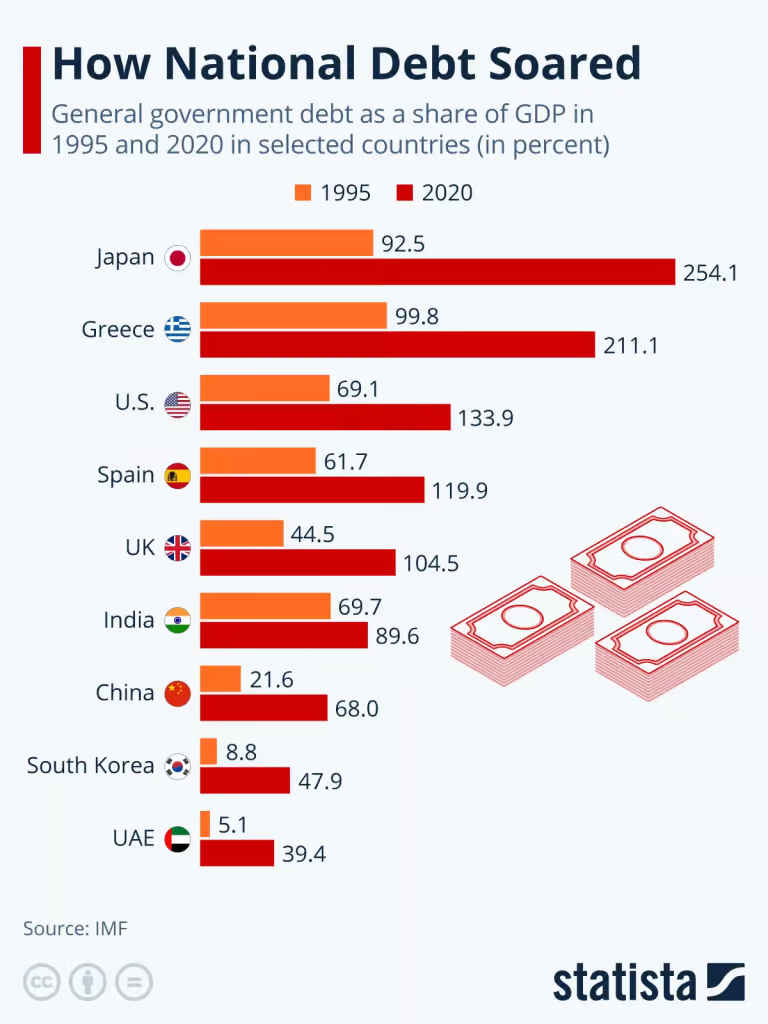

They kick off with the problem: America is “cruising” into an uncharted sea of federal debt, with a government seemingly incapable of turning it around.

In other words, the uniparty has set its course, and there’s no cavalry coming.

The Runaway Train

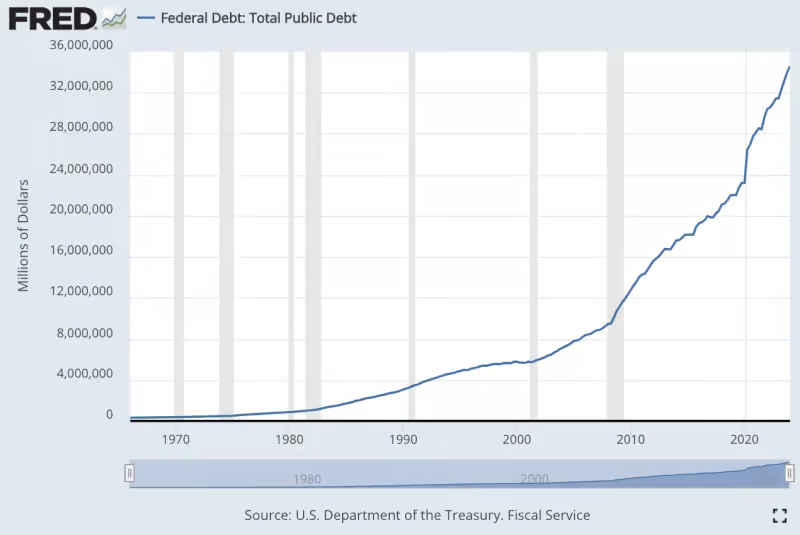

We’re currently adding a fresh trillion of debt every hundred days, on our way to $35 trillion.

Meanwhile, the deficit is about to break $2 trillion—for perspective, all federal revenue under George W Bush averaged around $2 trillion.

Debt interest alone is set to cross $1 trillion, eclipsing even our bloated military budget that beaches quarter-billion dollar piers in Gaza for sport.

The next milestone after that is Medicare spending, which together with Social Security has its own $78 trillion unfunded liability, according to its own Board of Trustees—outside estimates are higher.

Governments: Rabid by Nature

Now, none of this is shocking: governments by nature try to spend too much—indeed, much of economic history is made up of governments desperately trying to finance their mountains of debt.

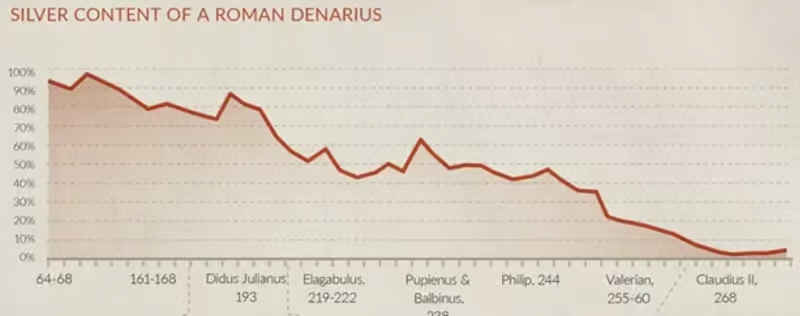

Debt brought down Rome, first with hyperinflation then with a gutted military that barbarians walked right over.

It brought down Spain, as New World gold finances an effective government takeover of the private sector. And France, bankrupted by financing foreign wars—in this case the American Revolution. The Qing collapsed under debt, and even Great Britain, who owned half the earth for nearly a hundred years.

It’s why we got the Magna Carta—indeed, Constitutions—as kings pleaded for more money. It’s how we got central banks, as first Britain then the rest of the world licensed money printers in exchange for debt finance.

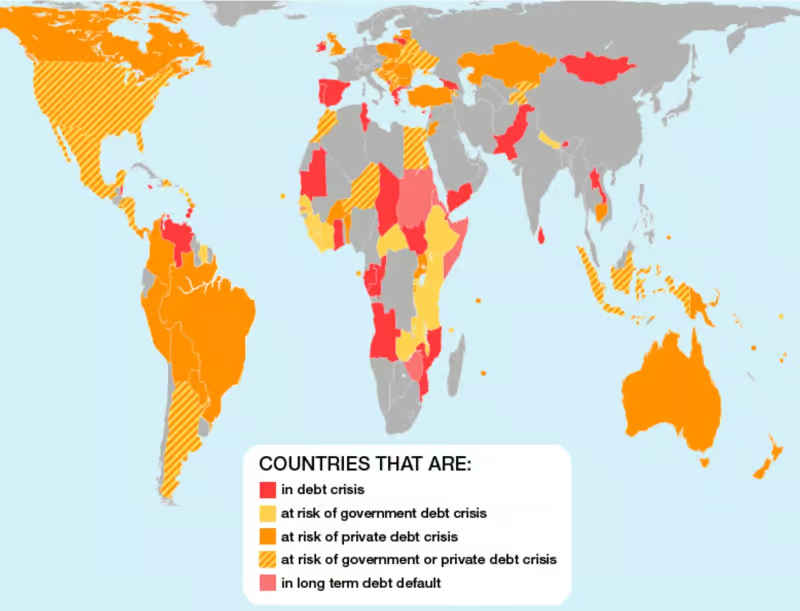

To this day government debt crashes countries—countries from Turkey to Venezuela to Nigeria are currently undergoing debt crises, with Argentina desperately trying to pull out of one.

How It Ends

And, with so many historical cases, we know exactly how this ends: investors stop buying government debt, shutting out governments and leading to massive austerity and soaring inflation as the government retrenches.

Going by history, government will cancel the trillions it promised—starting with social security and Medicare—then pull back to where it can pay the Praetorian Guard and not much else.

In short, once debt hits the magic line, Washington goes from Sugar Daddy to wild animal. And, historically, it happens much faster than people imagine—in Hemingway’s famous phrase, countries go bankrupt gradually then all at once.

What’s Next

Washington’s spending freight train can be stopped—in fact, we did stop it in the ’90s under Clinton and Gingrich: From 1997 to 2000 we ran budget surpluses totaling nearly $600 billion.

The key was gridlock—two parties that despised each other so much the only thing they could agree on was to sabotage each other’s plans.

Unfortunately, whether it was corporate donors or golden parachutes for politicians, both parties have long since folded and are now eager to cooperate so long as they both get everything they want. So Democrats feed their activist army at taxpayer expense, while Republicans instead give ammo to Ukraine.

This all means there is a ray of fiscal hope.

If, say, a President Trump were to face a Democrat Congress that hates him so much it blocks everything he does—not an impossible thing to imagine.

Or, if you swing that way, a President Biden—or Harris—subjected to similar antipathy from a GOP Congress.

Or, dare we dream, a GOP that actually stands up on the debt ceiling, damn the media torpedos.

In short, we as a nation face a choice: crisis in Washington today, or wait a couple of years and it’s a crisis in the entire country.

We know which one Washington will pick. But it’s ultimately the voters who run the joint.

Visualizing 1 Trillion

1,000,000,000,000

It’s hard to wrap your head around how big 1 trillion is, much less 35 trillion. Here are a few factoids to help you visualize just how big that number is:

There are 1 million seconds in 11.5 days. A trillion seconds is about 32,000 years.

If you could say one number every second, it would take about 11.5 million days to count to 1 trillion.

If you had spent $1 million every day since the birth of Christ, you still wouldn’t have spent $1 trillion.

If you line up dollar bills end-to-end, you could go to the moon and back around 203 times with $1 trillion. You could wrap them around the earth about 3,893 times.

If you stacked up 1 trillion dollar bills, the dollar tower would rise to 67,866 miles.

If a cup of coffee costs $3, you could buy 333 billion cups of coffee with $1 trillion.

If you had 1 trillion dollars, you could give every person on Earth approximately $125.

One trillion grains of rice would weigh about 20,000 metric tons.