A Taiwanese microchip giant has delayed production at its plant in Arizona, US, until 2025 due to a shortage of skilled labour.

Who produces the most chips in the world and are there other big players in the club? Sputnik explores.

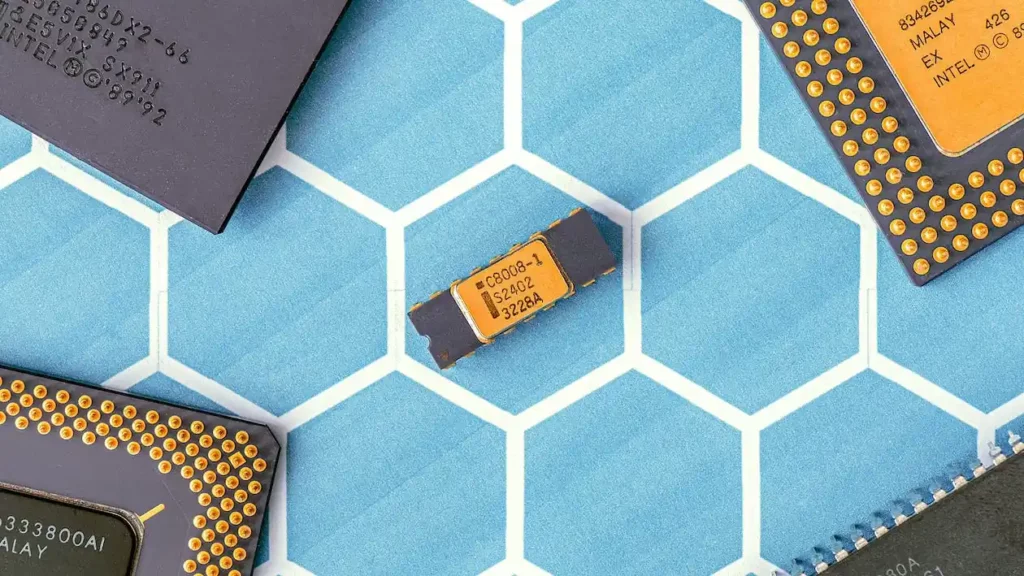

What is Microchip?

A microchip is a substance typically made of silicon, which has specific electrical properties (it conducts electricity more than an insulator, but less than a pure conductor) that allows it to serve as a foundation for computers and other electronic devices.

Also known as chips, semis or semiconductors, microchips can be found in such products as smartphones, appliances, gaming hardware, and medical equipment.

Who is World’s Largest Chip Supplier?

Taiwan remains the world’s undisputed leader in terms of raw semiconductor manufacturing and supplying.

The island currently produces more than 60% of the world’s semiconductors and over 90% of the most advanced ones.

Who is Taiwan’s Biggest Producer of Chips?

Most semis are manufactured by a single company, Taiwan Semiconductor Manufacturing Corporation (TSMC), which also controls more than half of the global semiconductor foundry market, by revenue.

Founded in 1987, TSMC, which is sometimes called just Taiwan Semiconductor, registered record earnings in 2022. This was followed by the firm’s profits being plummeted by about 23% to $5.8 billion in the past three months to the end of June, because of slower demand for chips.

Is TSMC Owned by China?

No, even though Beijing perceives Taiwan as an essential part of China, which it says should finally be peacefully reunified with the mainland.

TSMC is owned by its shareholders, and the largest one is the National Development Fund, which owns 6.4% of the company. A notable owner remains a company founder Morris Chang, whose stake is estimated to be around 0.5%.

Can TSMC Sell Chips to China?

Beijing has never said “no” to TMSC’s massive semiconductor exports to the mainland, given that China heavily relies on the company, which provides cutting-edge microchips for Chinese consumer electronics industry.

A couple of years ago, at least 40% of Taiwan’s total exports were microchips, with China and Hong Kong being two of their biggest importers.

But this year, Taiwan’s exports of integrated circuit chips (IC) to China and Hong Kong saw the largest fall since January 2009, in a sign of a global decline in electronics demand. The IC exports fell by 27.1% in January from a year earlier, according to the Taiwanese Finance Ministry.

Who Makes Microchips for China?

There are two largest chip manufacturers in China, the state-backed Semiconductor Manufacturing International Corporation, (SMIC), and Hua Hong Semiconductor.

SMIC said earlier this year that its 2022 revenue totaled $7.2 billion, up 34% year on year while its gross margin stood at a record 38%, the second year of sales growth above 30% for the company.

In the same vein, Hua Hong Semiconductors posted an annual growth of 51.8% in sales in 2022, a record high for the firm.

Other Chinese chip companies include HiSilicon, Yangtze Memory Technologies Corp (YMTC), UNISOC, Naura Technology Group, Will Semiconductor, Wingtech, GigaDevice Semiconductor, and Jiangsu Changjiang Electronics Tech.

Who Else Dominates Global Chip Industry?

Aside from TSMC, the top-three list includes South Korea’s Samsung Electronics (SEC) and Taiwan’s United Microelectronics Corporation (UMC).

Like TSMC, however, SEC expects a 96% profit plunge in the second quarter of 2023 as weak demand for memory chips persists, according to the company. UMC finance chief Chitung Li, in turn, said that his firm’s 2022 capital spending was $2.7 billion, less than the $3 billion previously planned, with 2023 spending set at $3 billion.

Other world chip giants include California-headquartered Global Foundries, the US’ Intel Corp., San Diego-headquartered Qualcomm Inc., plus such US tech behemoths as Micron Techology Inc., Broadcom Inc, Nvidia Corp., and Texas Instruments.

Is There Global Chip Shortage Now?

The ongoing semiconductor shortage involves numerous industries pertaining to the automotive and personal electronics sectors that were hit by the COVID-19 pandemic, which was declared to be over by the World Health Organization earlier this year.

Skyrocketing demand for mobile phones, laptops, and other electronic devices, along with the US’ protracted trade row with China and decreased manufacturing capacity in America, have sparked the semis industry crisis, according to media reports.

Is There Chip Race Between China and US?

Yes. China and the US continue to lock horns to prevail in the prospering global chip industry, which may grow to $1.4 trillion in revenue by 2030. White House statistics show that the US currently produces roughly 10%, while China accounts for at least 15% of semiconductor-related global production.

Washington is striving to win the competition by trying to impose further restrictions on Beijing and expanding investments in the domestic chip industry. In late June, an American media outlet reported that the Biden administration mulls introducing new curbs on US exports of artificial-intelligence chips to China, “as concerns rise over the power of the technology in the hands of US rivals.”

The US Commerce Department may announce the restrictions before the end of this month to stop the shipments of chips made by Nvidia and other semiconductor giants to customers in China and other countries of concern without first obtaining a license, according to the report.

Last year, Washington required licenses for those companies that export chips to China using US tools or software, no matter where in the world they are being made. The measures also keep US citizens and green card holders from working for certain Chinese chip companies. The restrictions were preceded by President Joe Biden signing into law a bipartisan CHIPS and Science Act which includes more than $52 billion for US companies producing semiconductors, as well as billions more in tax credits to encourage investment in the chip industry.

China, for its part, is seeking to develop its own technologies, instead of following in the footsteps of Western manufacturers. When it comes to the semiconductor industry, Beijing looks to expand the domestic technology to produce advanced silicon carbide chips.

In this regard, Beijing is sparing no expense in the research and development (R&D) of similar technologies. Premier Li Keqiang has already promised that the country’s R&D spending for the purpose would grow by more than 7% by 2025.

On its chip rivalry with the US, China’s Ministry of Commerce recently responded to restrictions by announcing that Chinese companies who plan to sell products containing rare earth metals gallium and germanium (which are used to manufacture chips) would need to first obtain an export license. This actually means that if the government refuses to issue such a license, a certain company will be banned from exporting.

Image credit: Jonas Svidras