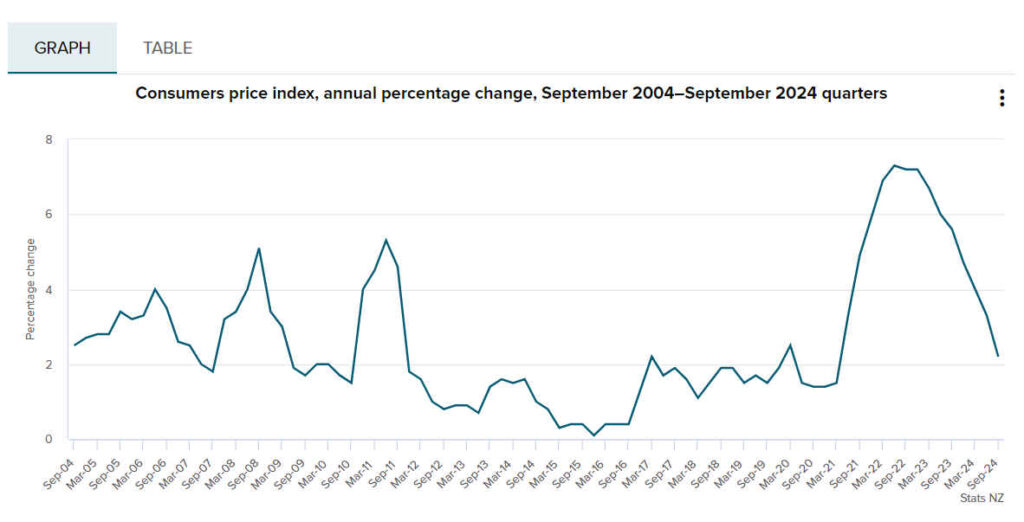

New Zealand’s inflation has slowed to its lowest level in three years, with the annual consumer price index (CPI) rising by 2.2% in the year ending September, down from 3.3% in the previous quarter.

This marks the first time inflation has fallen within the Reserve Bank’s target band of 1–3% since March 2021.

While prices continue to rise, Stats NZ reported that key factors driving the quarterly 0.6% increase in the CPI included higher local authority rates, food, and medical costs.

However, cheaper fuel, due to the scrapping of Auckland’s regional fuel tax, and the government’s Family Boost Scheme subsidy, which lowered childcare costs, provided some relief.

Non-tradable inflation, primarily driven by domestic factors such as rates and rents, was the main source of price pressures, with non-tradables rising 1.3% for the quarter and 4.9% over the year.

Notably, local authority rates saw a significant jump of 12.2%, the largest increase since 1990. In contrast, imported goods and services (tradables) saw prices fall by 0.2% for the quarter and 1.6% annually. The inflation numbers aligned closely with the Reserve Bank’s forecasts, boosting expectations of a potential official cash rate cut in November.

The CP Lie.

That might be housing inflation. However, the supermarkets didn’t get the memo.